Medicare Costs 2025: If you’re enrolled in Medicare and anticipating a hospital visit, understanding your costs in 2025 is more important than ever. Medical expenses can add up quickly, especially during inpatient stays, so knowing what you owe before stepping into a hospital can help you plan and avoid financial surprises. Medicare’s structure can be complex, but the good news is that much of the coverage is predictable—if you know what to expect.

The Medicare Costs 2025 updates released by the Centers for Medicare & Medicaid Services (CMS) reflect moderate changes to inpatient hospital care. For those staying less than 60 days, knowing how deductibles and benefit periods work is essential to estimating out-of-pocket costs. In this guide, we’ll break down all the details to help you stay informed and prepared.

Medicare Costs 2025: Inpatient Stay Rules and Cost Breakdown

When it comes to Medicare Costs 2025, the primary update for inpatient hospital care is a new deductible amount of $1,676 per benefit period. This is the amount beneficiaries must pay out-of-pocket before Medicare begins to cover costs. Once this is paid, Medicare covers the entire cost of inpatient stays up to 60 days, meaning there is no coinsurance during this time.

It’s important to understand that a benefit period is not based on a calendar year. It begins the day you’re admitted to a hospital and ends once you’ve been out of a hospital or skilled nursing facility for 60 consecutive days. Because there’s no cap on the number of benefit periods you can have in a year, you might end up paying the deductible more than once if you’re hospitalized multiple times.

Overview Table: Medicare Inpatient Costs for 2025

| Coverage Detail | 2025 Cost |

| Part A Inpatient Deductible | $1,676 per benefit period |

| Coinsurance for Days 1–60 | $0 (fully covered by Medicare) |

| Benefit Period Duration | Begins at admission; ends after 60 days out of hospital |

| Number of Benefit Periods Allowed per Year | Unlimited |

| Supplemental Coverage Options | Medigap or Medicare Advantage |

It’s Important to Know What Changes Are Coming to Medicare’s Inpatient Cost Structure

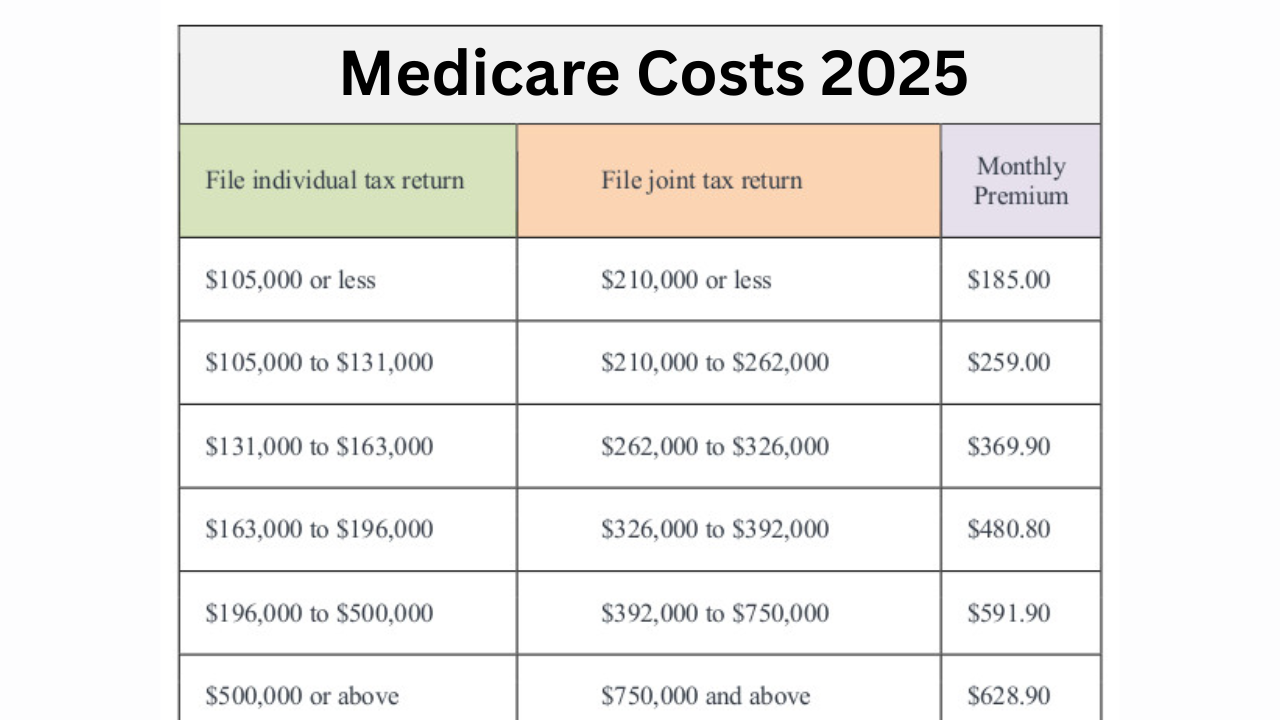

Medicare Part A covers inpatient hospital care, but you’re responsible for specific out-of-pocket costs before full coverage begins. The biggest change in Medicare Costs 2025 is the increase in the deductible—from $1,632 in 2024 to $1,676 in 2025. While the increase is small, it matters if you’re managing a tight budget or expect more than one hospital visit in the year.

The coinsurance structure remains the same. After paying your deductible, Medicare covers 100% of inpatient hospital costs for the first 60 days. No coinsurance is required within that window, making it a relief for those needing short-term care. After 60 days, however, daily coinsurance charges kick in, but this article focuses on stays of less than 60 days.

How the Costs Stack Up for Hospital Stays Under Medicare Part A

The cost system under Medicare Part A is straightforward once you understand the benefit period rule. Every time you enter a new benefit period, you owe the full deductible again. That means if you’re hospitalized in January and again in June after being discharged and out of care for more than 60 days, you’ll pay $1,676 each time.

After paying this deductible, you don’t owe anything for hospital services for the first 60 days. This structure benefits those with occasional, shorter hospital visits but can become costly for those with recurring admissions throughout the year. It’s one of the reasons many seniors choose to enhance their Original Medicare with a Medigap policy or switch to a Medicare Advantage Plan.

To Manage These Potential Expenses, Many Beneficiaries Opt for Supplemental Coverage

For those concerned about repeat costs, there are two primary options to limit financial risk: Medigap and Medicare Advantage.

Medigap (also known as Medicare Supplement Insurance) is designed to cover the out-of-pocket costs Original Medicare doesn’t pay, like deductibles and coinsurance. While Medigap policies come with premiums, they can save you from large hospital bills in years with multiple admissions. Plan types vary by state and provider but offer consistent coverage for inpatient care.

Medicare Advantage Plans (Part C) are another alternative. These private insurance plans bundle Part A and Part B coverage and often include extras like dental, vision, or prescription drugs. Most importantly, they have annual out-of-pocket maximums, offering a financial safety net Original Medicare lacks. Some plans may also cover the inpatient deductible entirely or charge lower co-pays depending on the provider.

Benefit Periods Can Multiply Your Costs If You’re Hospitalized More Than Once

A crucial point in understanding Medicare Costs 2025 is how benefit periods affect your finances. Unlike annual deductibles, the Part A deductible applies to each benefit period. If you’re admitted, discharged, and then readmitted after more than 60 days, a new benefit period starts, and you’ll owe the full deductible again.

This rule catches many beneficiaries off guard. For example, someone hospitalized in January, April, and September—each admission separated by at least 60 days—could owe the $1,676 deductible three times in a single year, totaling over $5,000 in out-of-pocket costs. Planning for this possibility is essential, especially for those with chronic health issues.

Why Planning Ahead Matters for Medicare Recipients

Whether you’re anticipating surgery, managing a chronic illness, or simply want to be prepared, it’s smart to plan for out-of-pocket costs under Medicare. Knowing your coverage inside and out helps avoid unnecessary debt or delayed care.

Consider reviewing your current plan or speaking with a Medicare advisor. If you’re already on a fixed income, a Medigap or Advantage Plan could offer peace of mind by capping unexpected costs. Also, always review changes annually, as Medicare updates often include small but important adjustments like the 2025 deductible increase.

FAQs

What is the inpatient hospital deductible for Medicare in 2025?

The deductible for each benefit period under Part A is $1,676 in 2025.

Do I pay coinsurance for a hospital stay under 60 days?

No. After the deductible is paid, Medicare covers the first 60 days in full with no coinsurance.

Can I be charged the deductible more than once in a year?

Yes. If you have multiple hospital stays separated by 60 days or more, each stay triggers a new deductible.

How can I avoid high inpatient costs?

Consider enrolling in Medigap or a Medicare Advantage Plan, which can help cover or reduce your deductible and other out-of-pocket costs.

What happens after 60 days in the hospital?

Coinsurance charges apply after 60 days. However, this article only covers stays under 60 days, which are fully covered after the deductible is met.

Final Thought

Understanding Medicare Costs 2025 helps you take control of your healthcare planning. Even minor changes—like the deductible increase—can have a big impact over time, especially for those with repeated hospital visits. Take this opportunity to review your current Medicare setup, and don’t hesitate to explore supplemental coverage options for added protection.

Got questions or experiences to share? Drop a comment and explore more guides that can help you stay informed on Medicare updates and healthcare planning in 2025.