How to Start an SIP Online in India: If you’ve ever thought about investing but didn’t know where to begin, SIPs may be the perfect starting point. With just a few clicks, you can begin your journey towards financial growth—right from your phone or computer.

A Systematic Investment Plan (SIP) offers a simple, structured, and accessible way to invest in mutual funds. With a minimal starting amount and the benefit of rupee cost averaging and compounding, SIPs are ideal for first-time investors as well as seasoned professionals.

Whether you’re planning for retirement, a future home, or your child’s education, this guide breaks down how to start an SIP online in India: a step-by-step guide to help you invest confidently and wisely.

Overview Table: How to Start an SIP Online in India

| Step | Details |

| Required Documents | PAN, Aadhaar, Address Proof, Bank Details |

| KYC Process | Mandatory (Online or Offline) |

| Investment Platform | Mutual fund website, app, or authorized distributor |

| Minimum Investment | ₹100 to ₹500 per month (varies by fund) |

| Fund Types | Equity, Debt, Hybrid |

| SIP Frequency | Monthly, Quarterly |

| SIP Date | Chosen by investor (can vary each SIP) |

| SIP Benefits | Compounding, rupee cost averaging, discipline, accessibility |

Understanding SIPs: The Basics

A Systematic Investment Plan allows investors to put a fixed sum of money regularly into a mutual fund. This investment method is popular because it promotes financial discipline, reduces the impact of market volatility, and helps build wealth over the long term through the power of compounding.

SIPs are not only suitable for those with limited knowledge of markets but also ideal for those who want to make investing a habit without actively tracking every market movement.

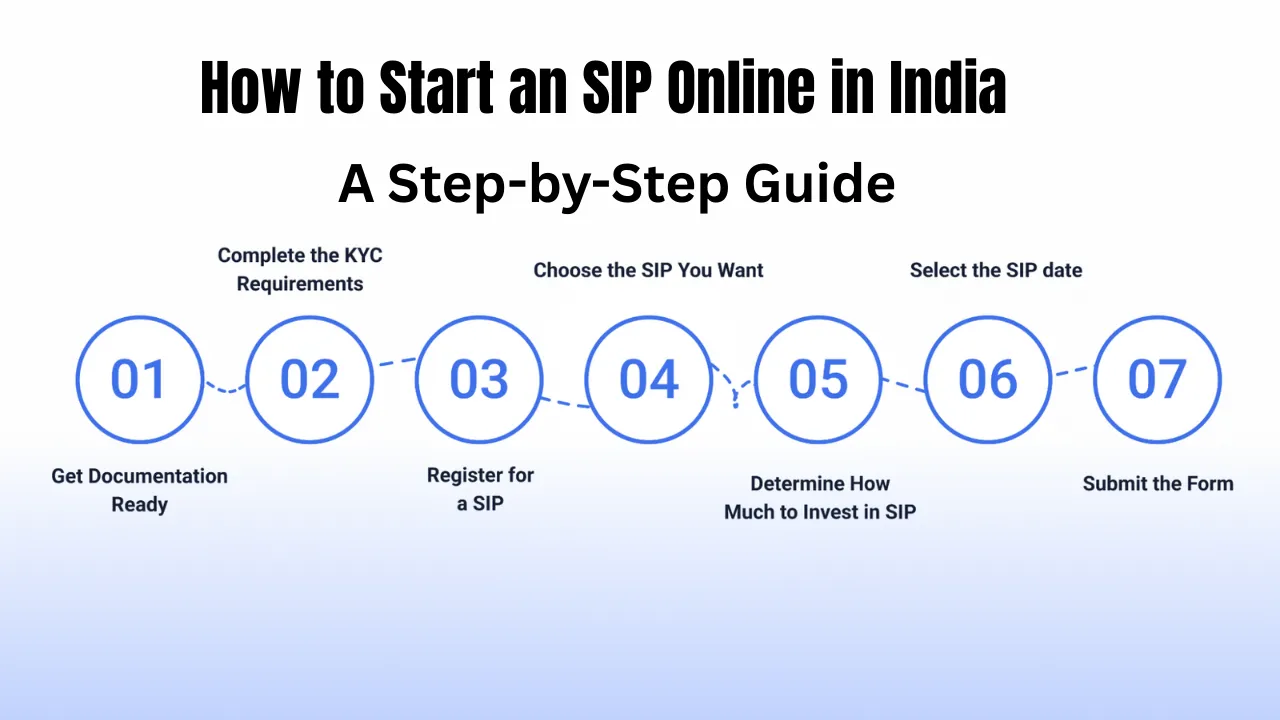

Step-by-Step Guide: How to Start an SIP Online in India

Let’s walk you through the process of setting up your SIP online—from documentation to execution.

Step 1: Gather Necessary Documents

Before starting, ensure you have the following documents ready:

- PAN card

- Aadhaar card

- Address proof (utility bill, rental agreement, passport)

- Bank account details (for auto-debit)

- A passport-size photo (for offline KYC, if required)

Having these details ready helps smooth the KYC and application process.

Step 2: Complete Your KYC (Know Your Customer)

KYC compliance is mandatory for all mutual fund investments in India. You can complete KYC online via eKYC by uploading documents and doing video verification through mutual fund platforms or apps.

You’ll need to provide:

- PAN and Aadhaar numbers

- A photo and digital signature

- Bank details

- A declaration of investment intent

Once your KYC is verified, you’re eligible to invest in SIPs.

Step 3: Choose a Fund Platform

You can register and invest in SIPs through:

- Mutual fund company websites

- Investment apps (like Groww, Zerodha Coin, or Bajaj Finserv)

- Financial advisors or brokers

- Online aggregators (ET Money, Paytm Money)

Choose a platform with good support, ease of use, and trusted credentials.

Step 4: Select the Right SIP Plan

There are several mutual fund types to choose from, and your selection should align with your financial goals and risk profile:

- Equity Funds: High return potential, suitable for long-term goals

- Debt Funds: Low risk, ideal for short- to medium-term planning

- Hybrid Funds: Balanced mix of equity and debt for moderate risk-takers

Before choosing, ask yourself:

- What is your investment horizon?

- Are you comfortable with market fluctuations?

- What’s your financial objective?

Use SIP calculators to estimate potential returns and compare fund performance and ratings.

Step 5: Decide the Investment Amount

There’s no fixed rule on how much to invest. Most SIPs allow you to start with as little as ₹100 or ₹500 per month.

Your investment amount should depend on:

- Your income and monthly savings capacity

- Short-term or long-term goals

- Desired corpus at the end of the tenure

You can always increase the SIP later or choose a Step-Up SIP where your investment grows annually with your income.

Step 6: Choose Your SIP Date

SIPs are flexible—you can pick any date in the month that’s convenient for you. Some investors align their SIP date with their salary credit date to automate savings before spending.

You can even select multiple SIP dates for different funds if you prefer spreading your investments across the month.

Step 7: Submit the Application and Make Payment

Once your plan, amount, and date are set:

For Online SIPs:

- Log in or register on your chosen platform

- Complete your KYC if not already done

- Select the mutual fund and SIP details

- Authorize online payments via net banking or auto-debit

- Receive confirmation and folio number

For Offline SIPs:

- Visit a fund house or financial advisor

- Submit KYC and SIP registration forms

- Provide cancelled cheque and auto-debit form

- Track status using the folio number

Once registered, the SIP will run automatically on your chosen date each month.

Benefits of Investing in SIPs

Starting an SIP online is not just easy—it’s loaded with advantages:

- Compounding Power: Returns earn more returns over time

- Rupee Cost Averaging: Buy more units at lower prices during market dips

- Discipline: Automates regular saving and keeps goals on track

- Diversification: Your investments are spread across asset classes

- Professional Management: Managed by expert fund managers

- Flexible: Pause, stop, or modify SIPs as needed

- Convenient: Set it once and let it run without effort

How Much Should You Invest?

There’s no one-size-fits-all answer. The amount you invest depends on your goals, risk tolerance, and how long you plan to stay invested.

Use this simple framework:

- Short-Term (1–3 years): Lower SIP amount in debt funds

- Medium-Term (3–7 years): Balanced SIP in hybrid funds

- Long-Term (7+ years): Higher SIP in equity funds for wealth creation

An SIP calculator can help you estimate how much to invest monthly to achieve your target corpus.

Tips for Successful SIP Investing

- Start Early: The sooner you begin, the more compounding works in your favor

- Set Clear Goals: Know what you’re investing for—retirement, education, etc.

- Review Periodically: Check performance annually and adjust if necessary

- Stay Invested: Avoid reacting to short-term market dips

- Use Top-up SIPs: Increase investment as income rises

- Diversify: Don’t put all money into one fund or type

- Seek Advice: If unsure, consult a financial advisor

Final Thought

Investing doesn’t need to be complex or intimidating. With SIPs, even a beginner can build wealth steadily over time. Knowing how to start an SIP online in India: a step-by-step guide empowers you to take control of your finances from the comfort of your home.

Start with a small step today and watch it turn into a meaningful financial journey tomorrow. The earlier you begin, the more you benefit from consistency and compounding.

Ready to invest? Open your preferred mutual fund platform and take your first step toward financial freedom.