$278 Social Security Payment Cut 2025: Recent headlines about a $278 Social Security Payment Cut 2025 have caused concern for many retirees and beneficiaries. With Social Security serving as a key source of income for millions of Americans, it’s no surprise that talk of any reductions sparks fear. But before panic sets in, it’s important to know that this “cut” is not what it seems. In reality, it refers to a specific Medicare premium, not a reduction in actual benefits.

This article will break down what this $278 figure really means, how it affects your monthly payments, and what steps you can take to stay protected financially.

$278 Social Security Payment Cut 2025

Let’s be clear from the start: this is not a cut in Social Security itself. The $278 refers to a Medicare Part A premium that some individuals may have to pay. Most people don’t pay this premium because they’ve worked enough years (quarters) in jobs covered by Medicare. However, if you haven’t met that minimum work history, you’ll be required to pay this amount.

People with 30 to 39 quarters of Medicare-covered work pay $278 per month for Part A. If you’ve worked less than 30 quarters, the monthly premium jumps to $505. These premiums are deducted directly from your Social Security check, which is why it might appear that your payment has been cut.

Overview Table: Key Information

| Detail | Information |

| What is the $278 Cut? | Medicare Part A premium for those with limited work credits |

| Who Pays It? | Individuals with 30–39 quarters of Medicare-covered work |

| How It’s Paid | Deducted from monthly Social Security check |

| Real Impact | Lower take-home benefit amount |

| Other Risk | Future benefit reductions due to funding issues |

Why This Isn’t a Direct Social Security Cut

It’s important to understand that Social Security and Medicare are two separate programs. Social Security provides monthly income for retirees and disabled individuals. Medicare, on the other hand, is health insurance for those 65 and older.

For most people, Medicare Part A (which covers hospital services) is free. But if you didn’t work enough years in a Medicare-covered job, you’re responsible for paying a monthly premium. This amount is automatically deducted from your Social Security check, which can make your monthly payment appear lower than expected.

Real-Life Impact Examples

Let’s take a closer look at how this plays out:

John, age 67, worked part-time jobs throughout his life and only earned 32 quarters of Medicare-covered employment. He now has to pay $278 each month for Part A, deducted directly from his $1,400 Social Security check. He only receives $1,122 a month after the deduction.

Maria, age 72, worked full-time for over 10 years and qualified for premium-free Medicare Part A. Her entire $1,400 check remains intact, except for the standard Medicare Part B deductions.

The difference is significant and illustrates why understanding your eligibility is so important.

Other Factors That Can Reduce Your Social Security Payments

1. Medicare Part B Premiums

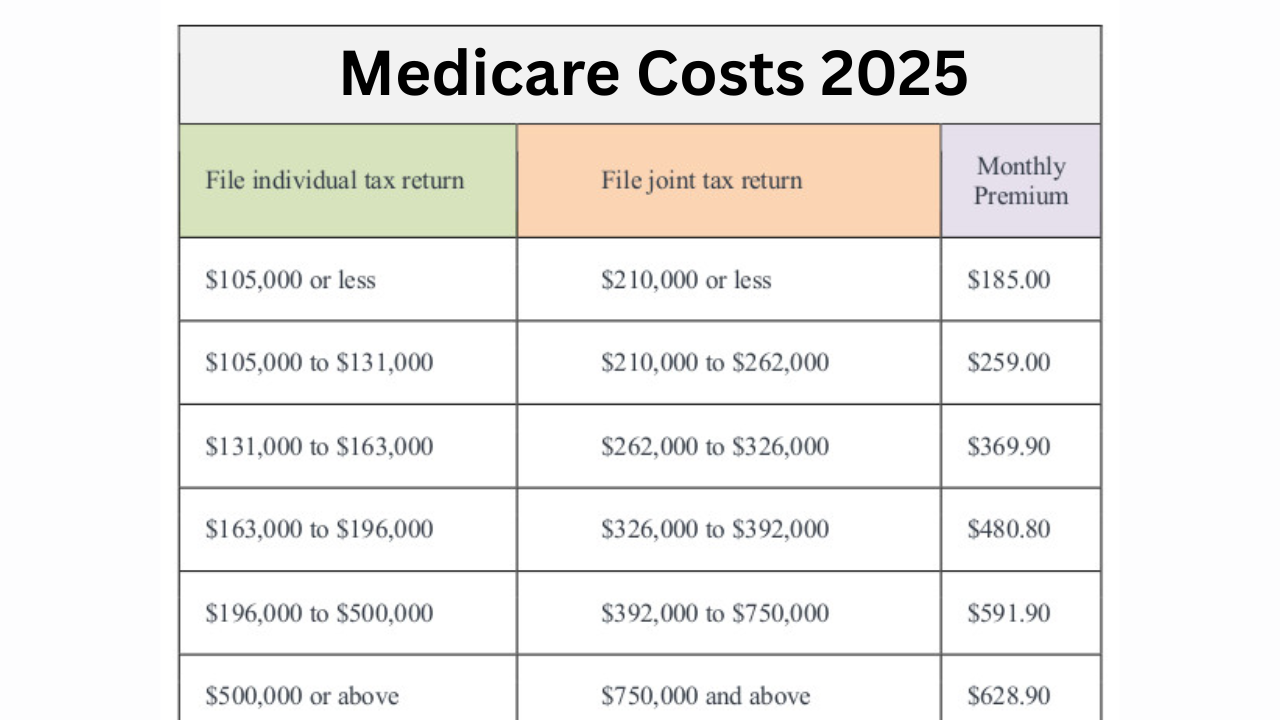

Even if you qualify for free Part A, most people still pay a monthly premium for Part B, which covers medical services. This premium is also deducted from your Social Security check. The standard amount is around $185 per month, though high-income earners may pay more.

2. Overpayment Recovery

In 2025, the Social Security Administration is adopting stricter rules for reclaiming overpaid benefits. If you’re found to have received too much in past benefits, your entire monthly payment could be withheld until the overpayment is repaid. This is a big change from previous rules that capped recoveries at 10% per month.

3. Social Security Benefit Taxation

If your total income is over a certain amount, a portion of your Social Security benefits may be taxable. For individuals earning over $25,000, or married couples earning over $32,000, up to 85% of your benefits could be taxed. This reduces your take-home income further.

Long-Term Concerns for Social Security

Beyond the $278 Medicare premium, there are growing concerns about the future of Social Security funding. The program’s trust fund is projected to be depleted by 2033. Without reforms, beneficiaries might see a 21% cut in payments.

For example, someone currently receiving $1,600 a month could see their payment reduced to $1,264. That’s over $4,000 less per year. These projections are a reminder of the need for broader financial planning beyond just relying on Social Security.

How to Protect Yourself Financially

Here are a few proactive steps to make sure you’re maximizing your benefits and preparing for any deductions or changes:

1. Check Your Work History

Create a My Social Security account online. You can review your earnings history, verify the number of quarters worked, and estimate your future benefits. This will help you know if you qualify for premium-free Medicare.

2. Understand Your Medicare Coverage

Medicare has multiple parts, and knowing what you’re enrolled in—and what you might need—can help you manage costs:

- Part A: Hospital coverage. Free if you worked enough quarters.

- Part B: Medical coverage. Monthly premium applies to all.

- Part C (Medicare Advantage): Offers bundled plans through private insurers.

- Part D: Prescription drug coverage.

Make sure you’re enrolled in the right plan for your needs.

3. Budget for Healthcare Expenses

Even with Medicare, there are costs for prescriptions, co-pays, and services not fully covered. Experts estimate a couple retiring at age 65 may need hundreds of thousands of dollars for healthcare over their retirement. Consider these potential expenses when planning your monthly budget.

4. Seek Professional Advice

A certified financial planner or retirement advisor can help you make smarter decisions. They can guide you on when to claim benefits, how to reduce taxes, and how to build a backup income plan beyond Social Security.

5. Keep Your Information Updated

Make sure your Social Security and Medicare accounts have your current address, bank details, and contact information. Delays or missed payments often happen when records are outdated.

FAQs

Is the $278 deduction a benefit cut?

No. It’s a Medicare Part A premium for individuals who didn’t work enough years to qualify for free coverage.

Can my entire Social Security payment be withheld?

Yes, if you’ve been overpaid and haven’t repaid the debt. Starting in 2025, SSA can withhold 100% until the amount is recovered.

Will Social Security run out of money?

The trust fund is expected to be depleted by 2033. After that, benefits could be reduced unless changes are made.

How do I know if I have to pay the $278?

Log into your Social Security account and check your work credits. You need 40 quarters (10 years) to avoid the premium.

What if I can’t afford Medicare premiums?

You may qualify for assistance through Medicare Savings Programs or Medicaid, depending on your income and state.

Final Thoughts

The $278 Social Security Payment Cut 2025 is more of a misunderstood deduction than an actual loss in benefits. It highlights the importance of knowing how Medicare works, planning for healthcare costs, and keeping up with policy changes that could impact your retirement.

By staying informed and proactive, you can avoid surprises and make the most of the benefits you’ve earned over your working years.